Editor's take: Nvidia's is now hailed for its single-minded vision of giving birth to AI. But the real lesson from their success is better demonstrated by their failures. This is a company that is not afraid of taking risks.

Back in business school, I had secured an interview for a really great job. The interview was scheduled early in the morning, but I woke up early. Had some coffee. Reviewed my notes. I was ready. This was long enough ago that I was using a cordless, landline phone to call in.

I picked up the phone and there was no dial tone. I burst into my roommate's room, but his wired phone did not work either. I then turned to my cell phone, but I lived in a large dark zone in the coverage map and could not connect that way either. A complete telecoms failure.

Editor's Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

I then had to run around the neighborhood until I found a payphone at a gas station a few blocks from the apartment. (Yes – cordless, landlines, dial tones, urban coverage holes, and payphones – this was a long time ago.) Standing in the middle of a gas station at a busy intersection I finally connected, 30 minutes late. The managing director's assistant answered the phone and told me "Yes, he understands you were delayed, and asks that you call back when you actually want this job."

I was prompted to think about this recently while listening to sessions at Nvidia's GTC developer conference. At one point, someone asked CEO Jensen Huang about their Hopper CPU in its relation to other Arm-based CPUs, and it occurred to me that not so long ago, Nvidia tried really hard to buy Arm. Where would Nvidia be today if that deal had happened?

Nvidia abandoned the deal in early 2022. If the deal had gone through it likely would not have closed until the end of that year. And of course, late that year in November, OpenAI launched ChatGPT and turned the world upside down.

Given that timing, If the deal had gone through, it is very possible that the integration of Arm would have become a second tier problem. Nvidia would still be riding high, and it is hard to see the management team devoting as much energy to boring integration issues when they could literally become AI rockstars. Arm probably would have suffered as a result, still large, but languishing as a bit of an afterthought.

By comparison, what if the deal had sailed through and closed earlier in 2022 and become a focus of Nvidia. Would they have missed ChatGPT? Probably not, Nvidia had been betting heavily on AI for a long time and it is unlikely they would have let the opportunity slip, but they may not have executed as well as they are now, constantly dealing with Arm integration and trying to shoehorn that narrative into the AI narrative.

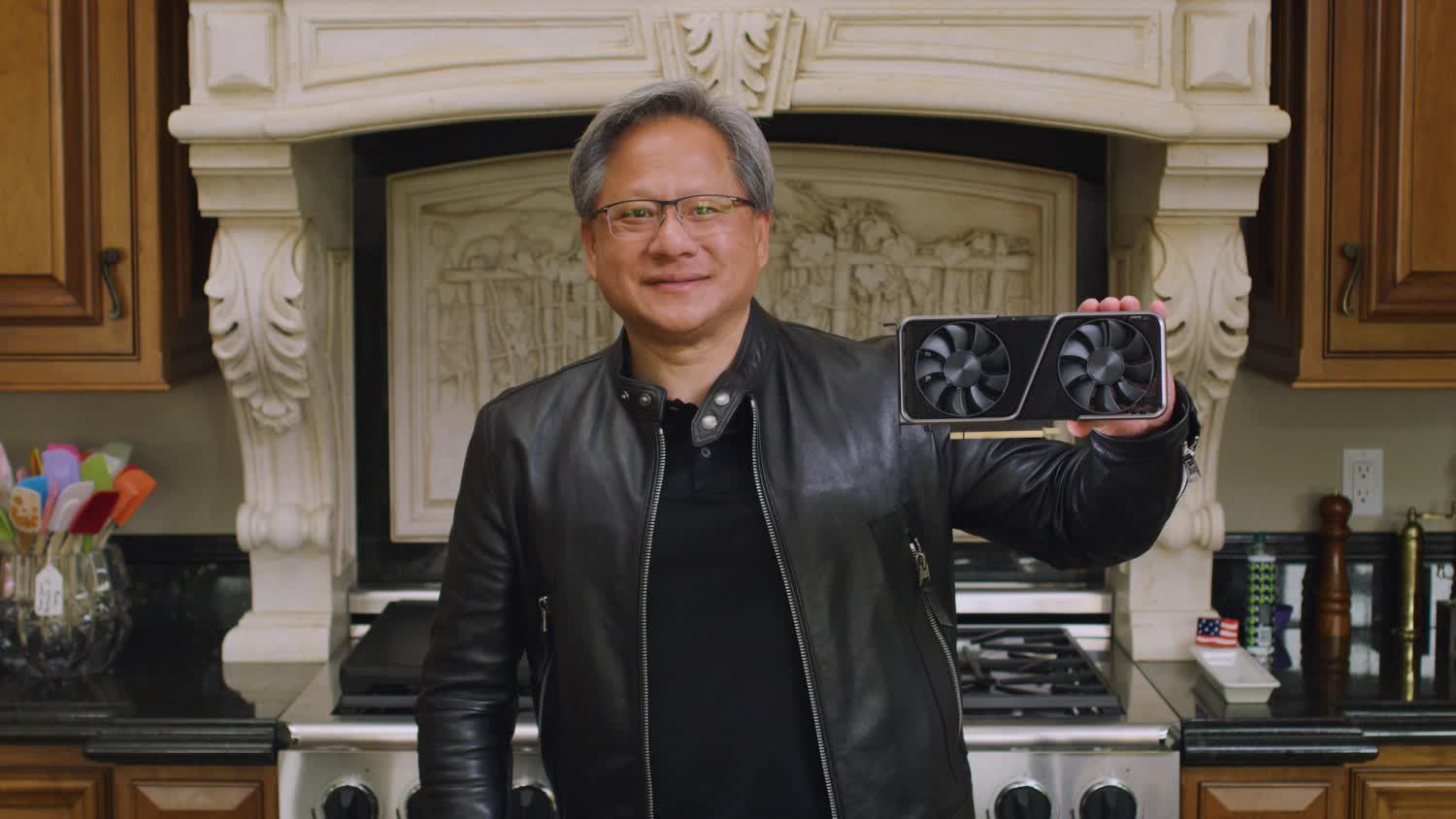

We mention this because Nvidia's GTC has become a big event – celebrating Nvidia's rise to the top of the semiconductor ranks. They took some big risks and had the foresight to invest heavily in machine learning, AI, transformers and all the rest of what they now label "Accelerated Compute." The company, and their CEO in particular, deserve immense credit for sticking to their vision.

This is not the story of a company with a single focus, sticking to their guns amidst a sea of naysayers. Instead, we see this as a company that has never been afraid to take chances...

That being said, I think that's the wrong lesson to take away from Nvidia's success. In hindsight, it is easy to say that Nvidia saw the future and reshaped the company to become the leader in AI, but that is not what happened. This is not the story of a company with a single focus, sticking to their guns amidst a sea of naysayers. Instead, we see this as a company that has never been afraid to take chances, to try out many different things, and accept that some of them will end in failure.

Dig through the archives and you can find a lot of things the company did not do right. Not so long ago, they were the leader in silicon for crypto digital coins. At GTC, Huang said the company was probably out of that market entirely. For years, all they talked about were autonomous vehicles. Those are still somewhere in the mix, but garner very little attention nowadays.

Anybody remember 'Icera' who Nvidia acquired a decade ago to make a stab at competing with Qualcomm for cellular modems? No worries, no one else remembers that either.

Arm could very well have ended up as another one of those diversions. We never thought the strategic case for that deal was terribly solid. They could have made it work, but it always risked being a distraction. Again, in hindsight, this is another one of those deals which ended up better for it never happening.

So as you listen to Huang's keynotes, and hear all the talk about their vision of the future – AI factories, Omniverse, 6G (lord, help us), and all the rest – take them all with a grain of salt. They are good ideas (mostly). Some of them could turn out to be incredible businesses. But they each matter less than the fact that Nvidia is willing to try all of them out.

The company's vision of the future, like its products, is not deterministic. Nvidia is playing, and playing, the odds, and that ability to take risks is the key to their success.